ANNOUNCEMENT

QAD Redzone acquires Kavida — our Agents have joined the Champion AI family

Discover how AI agents are reshaping the manufacturing operating model

Hi, I’m Alison!

Share your details, and I’ll give you a call in minutes to see how we can assist.

Buffer Stock Is a Symptom of Blind Spots — How Agents Use Risk Analysis to Optimize Inventory

September 21, 2025

5 min read

Author:

Sumit Sinha

CTO & Co-Founder, Kavida.ai

Author:

Sumit Sinha

CTO & Co-Founder, Kavida.ai

Why We Need to Rethink Buffer Stock

In supply chain circles, buffer stock is often seen as a smart move – a little extra product tucked away “just in case” something goes wrong. It’s meant to protect you from surprises like late deliveries, sudden spikes in demand, or supplier hiccups.

But here’s the thing: buffer stock isn’t really a strategy. It’s a reaction. It’s what you do when you don’t have enough visibility or confidence in your supply chain. Think of it like keeping an umbrella in your bag because you don’t trust the weather forecast, not because you enjoy carrying it around.

That “just in case” mindset comes at a cost. Extra inventory ties up cash, takes up space, and risks sitting idle for months. And while it might solve today’s problem, it often hides the deeper issues that created the uncertainty in the first place.

With the right tools, you don’t have to keep playing it safe with excess stock. Instead, you can shine a light on the blind spots causing the uncertainty and fix them.

The Hidden Price of Playing it Safe

For finance leaders, buffer stock shows up as numbers that hurt: high Weeks on Hand (WoH), low inventory turnover, and money tied up in products that aren’t moving.

Cash locked away

Every unit sitting in a warehouse is money you can’t use for growth, innovation, or even day-to-day operations.

Rising storage costs

More stock means bigger bills for warehousing, insurance, handling, and overhead costs.

Risk of loss

The longer products sit, the greater the cΩhance they’ll expire, become outdated, or need to be written off.

Most of the time, these costs are treated as the price of avoiding disruption. But if we can tackle the root causes of uncertainty, there’s no reason to keep paying that price.

Using Agents to Remove the Guesswork

Instead of asking, “How much extra should we order to feel safe?”, AI agents like Agent PO let teams ask, “How can we reduce the risks that make extra stock necessary in the first place?”

Example: Cutting down on stagnant inventory and high WoH

Real-Time Inventory Alerts

Get notified when Weeks of Holding (WoH) starts creeping too high so you can act before costs pile up.

Stagnant Stock Reports

Spot items collecting dust early with reports that highlight slow movers before they become dead stock.

Turnover Pattern Analysis

Analyze product turnover trends to uncover ordering patterns and improve accuracy in replenishment decisions.

Instant SKU Queries

Run quick queries in seconds—like seeing which SKUs slowed down the most this month—to guide fast actions.

This means you can match orders to real demand, avoid stockpiling, and keep cash flowing where it’s needed most.

Tackling the Other Side of the Problem: Supplier Risk

A lot of buffer stock is about protecting against unreliable supply. If a shipment is late, a factory shuts down, or a supplier fails a compliance check, you risk running out of stock. So, the instinct is to order more than you need, just in case.

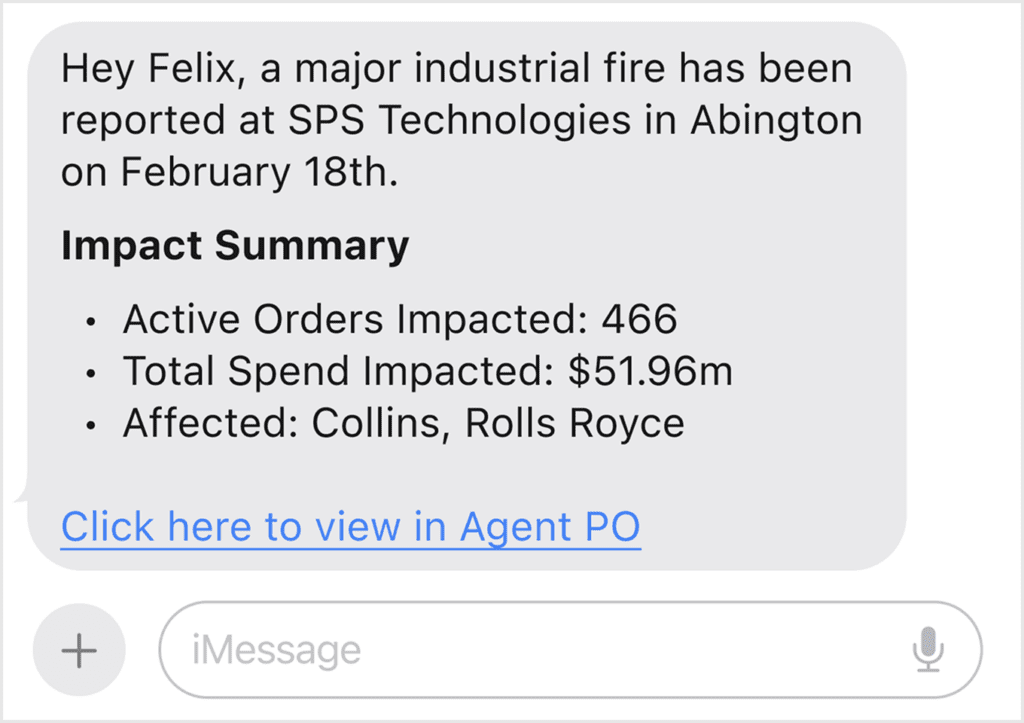

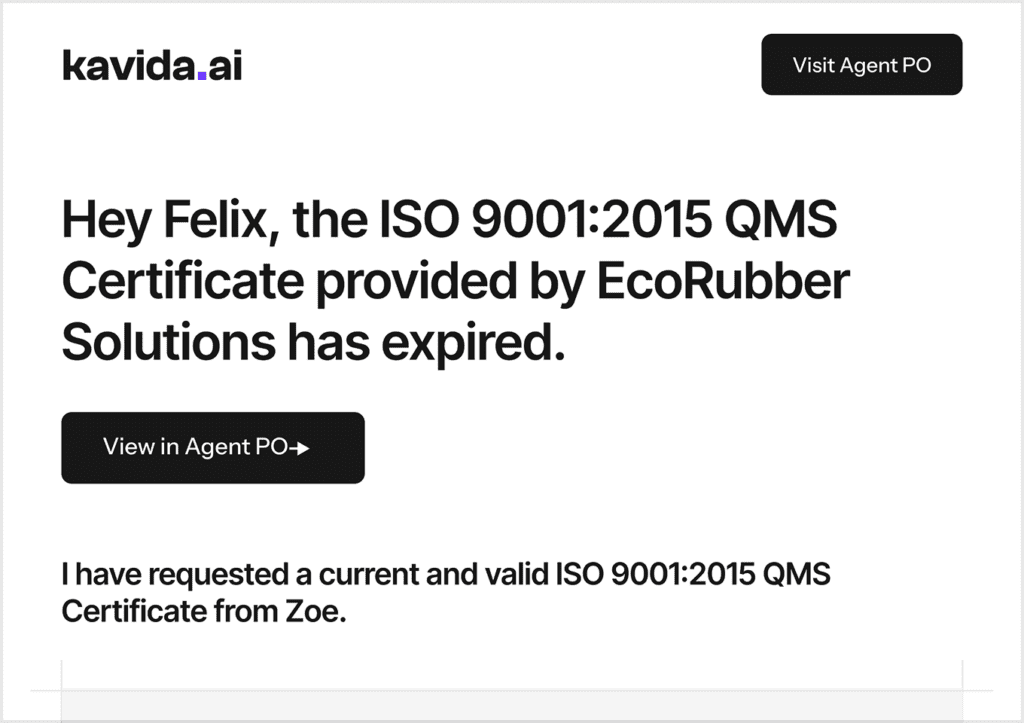

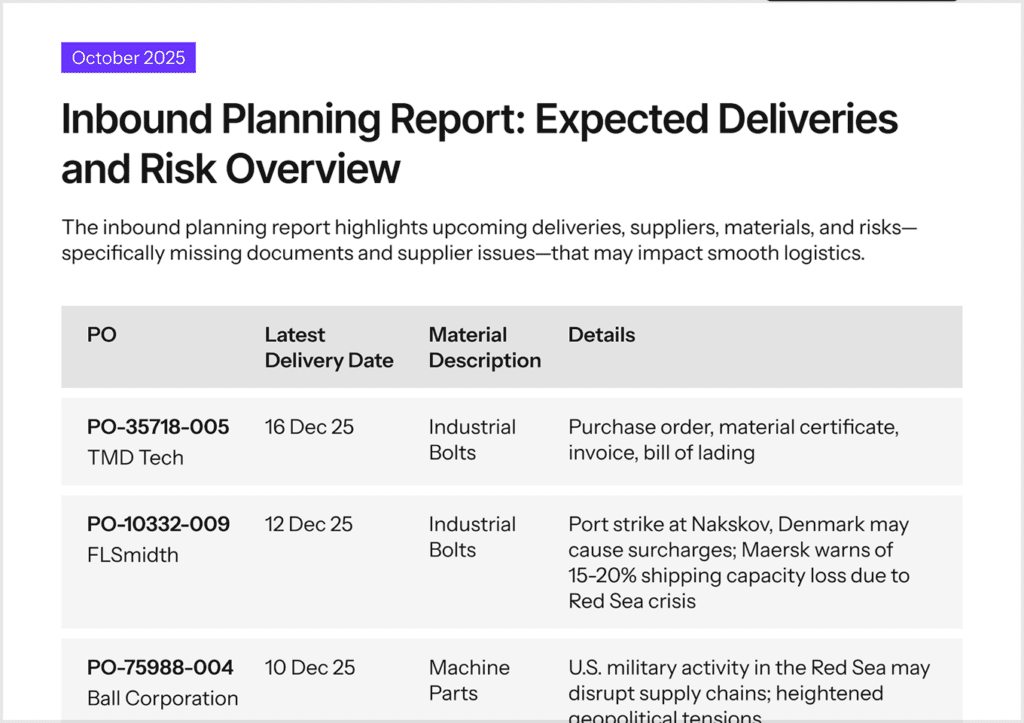

Agent PO’s Supplier Risk Alert system flips this approach on its head. Instead of holding extra “just in case,” you can track potential risks in real time and act before they cause trouble.

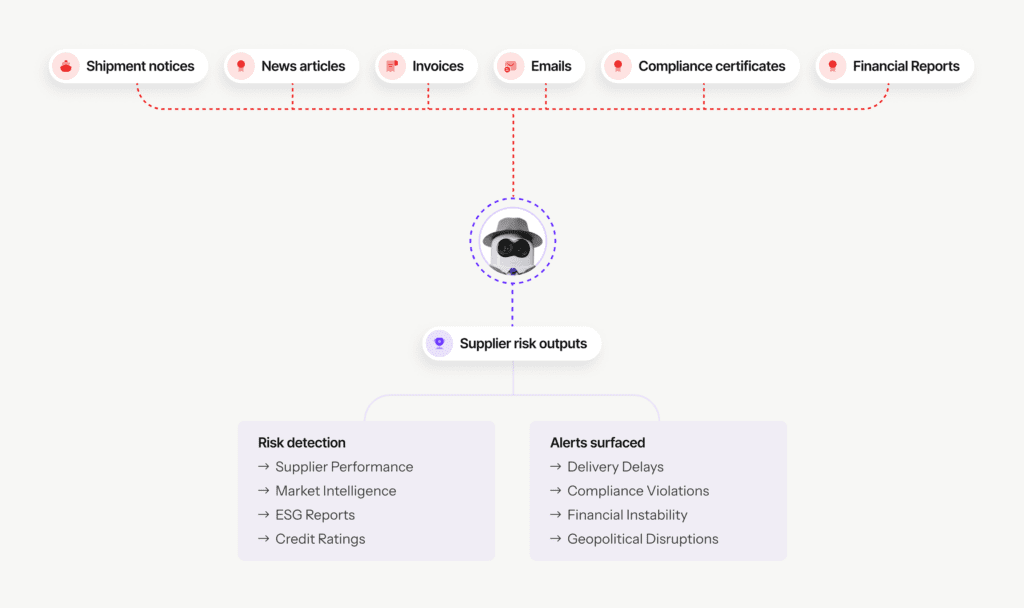

Here’s how it works

Monitors financial health, geopolitical events, and compliance status for your suppliers.

Instant alerts on new risks—reroute orders, arrange backups, or adjust plans fast.

Flags expired certifications or contracts before they disrupt your supply chain.

Warns you about single-source risks, so you can diversify before it’s urgent.

When you have early warning, you don’t need to hide behind a wall of excess stock. You can take direct action and keep inventory lean without risking stockouts.

Making the Shift: From Just-in-Case to Just-in-Time

Buffer stock is a safety net. But safety nets are for when you fall. Agent-powered risk analysis gives you a smart net that spots the gaps and fixes them before you ever need to fall back on extra inventory.

The benefits of moving beyond buffer stock:

In a world where supply chains face constant change with shifting markets, geopolitical shocks, environmental disruptions, relying on excess stock is a costly habit. By tackling the root causes of uncertainty, you can run a leaner, more agile operation that’s ready for whatever comes next.

Buffer stock is a symptom. Agents are the cure.

Related articles

How Agents Unlock Supply Chain Integration After M&A

Mergers and acquisitions promise scale, efficiency, and new market reach — but in supply chains...

Overcoming The P2P Deployment Bottlenecks That Could Kill Your Transformation

For organizations implementing or considering a Procure-to-Pay (P2P) system, it is important to understand that achieving...

How Agent PO Empowers Chief Procurement Officers in Manufacturing

In manufacturing, the Chief Procurement Officer (CPO) is tasked with driving procurement excellence, minimizing costs, mitigating risks, and supporting business growth by ensuring an efficient supply chain.