ANNOUNCEMENT

QAD Redzone acquires Kavida — our Agents have joined the Champion AI family

Discover how AI agents are reshaping the manufacturing operating model

Hi, I’m Alison!

Share your details, and I’ll give you a call in minutes to see how we can assist.

If you sit with a sales team on a busy Monday, you can hear pricing happen. Not the strategy decks—the real thing: a rep scrolling past orders in the ERP, a manager asking “what did we sell it for last time?”, someone digging through a spreadsheet named Final_FY23_v7 (1).xlsx. The decision that determines whether you win the RFQ and protect margin is often made in fragments, under time pressure, with partial context.

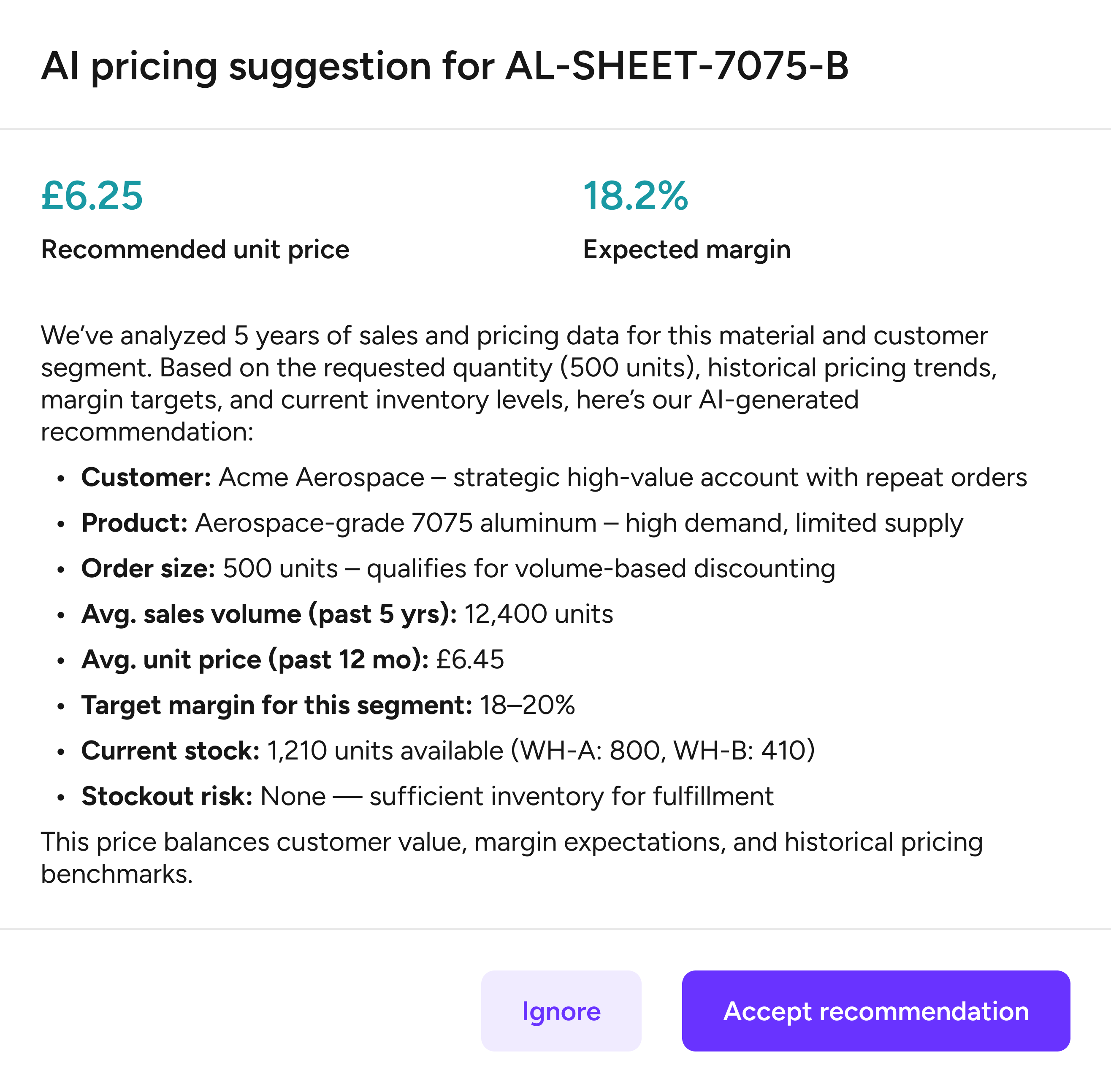

Kavida’s view is simple: pricing shouldn’t be a memory game. It should be a system. The moment an RFQ arrives, the right data should assemble itself. The ERP should be ready with a quote and the sales rep should see a recommendation—explained, defensible, and adjustable—without leaving the workflow. That is what we mean by Intelligent Pricing.

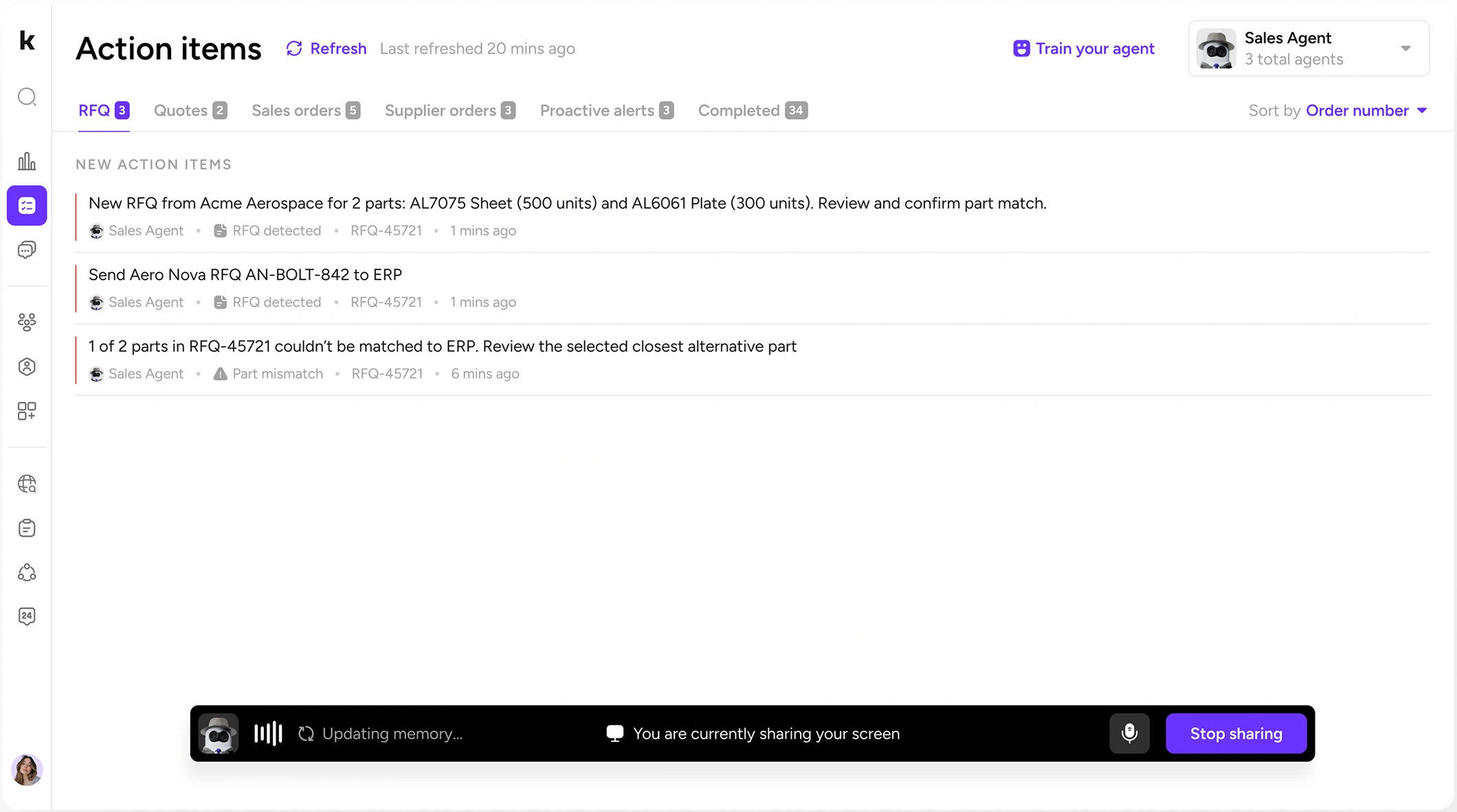

How the Sales Agent and Its Intelligent Pricing Works

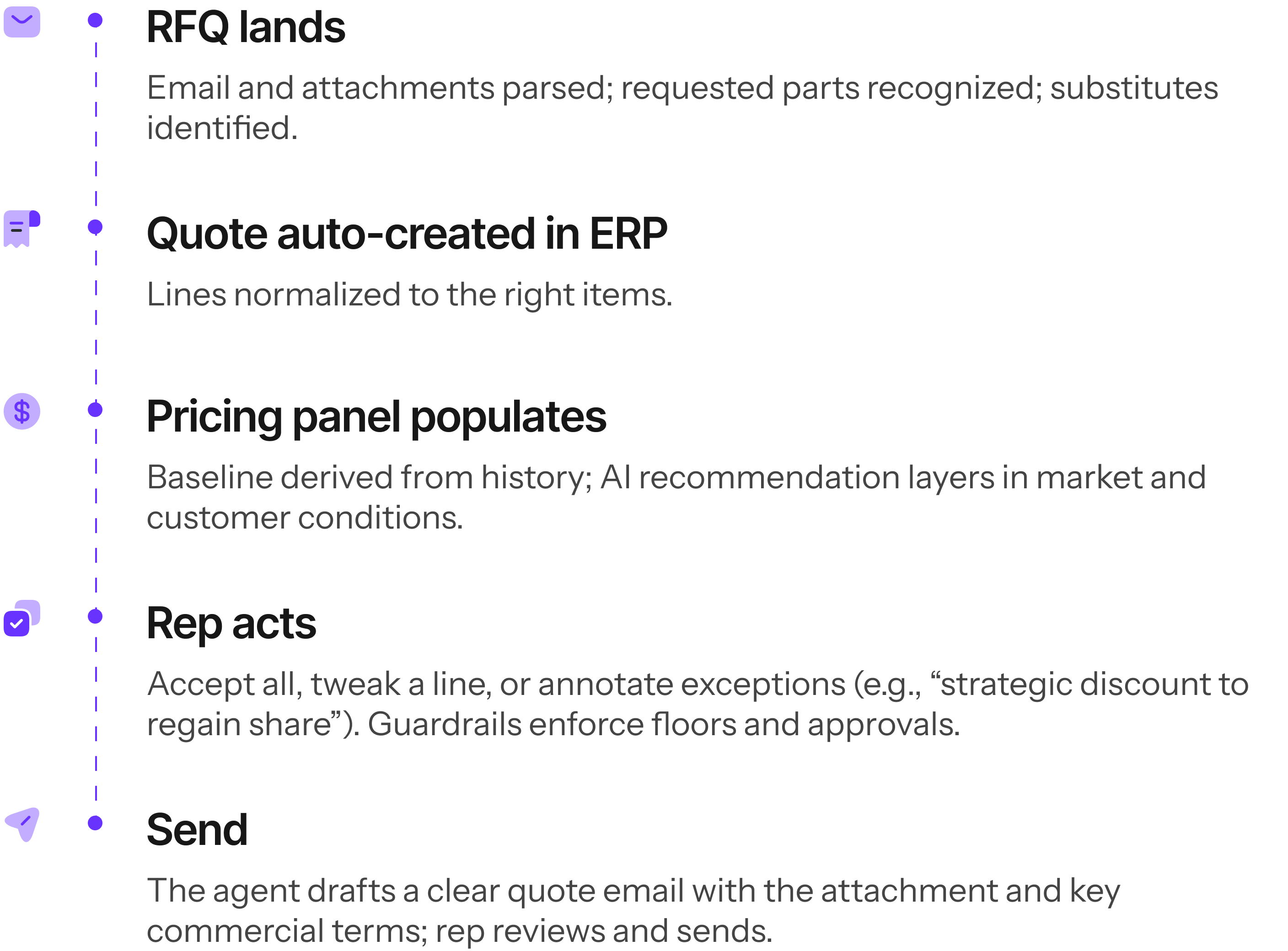

When a customer sends an RFQ, the agent ingests the email and attachments, extracts the requested parts and quantities, and immediately triggers the ERP workflow to create a quote. By the time the rep clicks into it, lines are normalized against the ERP item master, and related parts or substitutes are flagged. .

The agent keeps going – it assembles everything that typically lives across tools and teams: historical average order size, prior sell prices to this customer and similar accounts, total spend and trajectory, lead times, current availability, and margin rules. That gives you a universal baseline—the consistent logic your best reps already apply, now applied every time.

Then the AI adds what humans struggle to do at scale: read today’s market and this customer’s current reality and weigh them properly in the moment.

What Changes With Intelligent Pricing

Intelligent Pricing replaces personality-driven decisions with a universal baseline plus dynamic signals. The baseline uses facts you already trust — past sell prices and discounts, historical margins by segment, typical order sizes, contracted terms. The dynamic signals adapt to the specifics of the moment:

Customer health and value

Lifetime spend, recent activity, payment behavior, and time since last order (you may sharpen pricing to win back a lapsed account).

Market and availability

Shortage or surplus signals, supplier updates, seasonality, and lead-time pressure that shape current market and guide near-term action.

Volume and basket effects

Order size and cross-line dynamics that justify sharper positioning on select items, aligning pricing with demand shifts.

Profit guardrails and controls

Company targets, floor/ceiling bands, and approval rules protect margins and keep pricing consistent with agreed policy limits.

Reps can see the drivers (for example, average sales volume over the last 5 years, target margin for this segment, customer classification etc.), understand the margin impact line by line, and accept or adjust in one click.

If they disagree, that signal is captured. Over time, the agent learns how your organization actually prices edge cases and encodes that judgment.

Data That Makes It Smart (Not Just Automated)

The agent connects to:

ERP for item master, costs, stock/ATP, historical sales and quotes, lead times, price lists, and approvals.

CRM for account tiering, growth potential, relationship context, and contracted terms.

Order and quote outcomes to close the loop—what won, what lost, and at what price.

External market cues to flag supplier signals/risks, shortage indices, seasonal dynamics.

Trained on your data & interactions: The agent is trained on your company’s historical transactions and day‑to‑day interactions with your customers. It internalizes negotiation norms, discount patterns, account‑specific behaviors, and typical concessions — so recommendations reflect how your team actually sells, not a generic model.

It’s the combination — historical behavior, current market, and present customer state — that lets the agent recommend a number that is both competitive and margin-conscious.

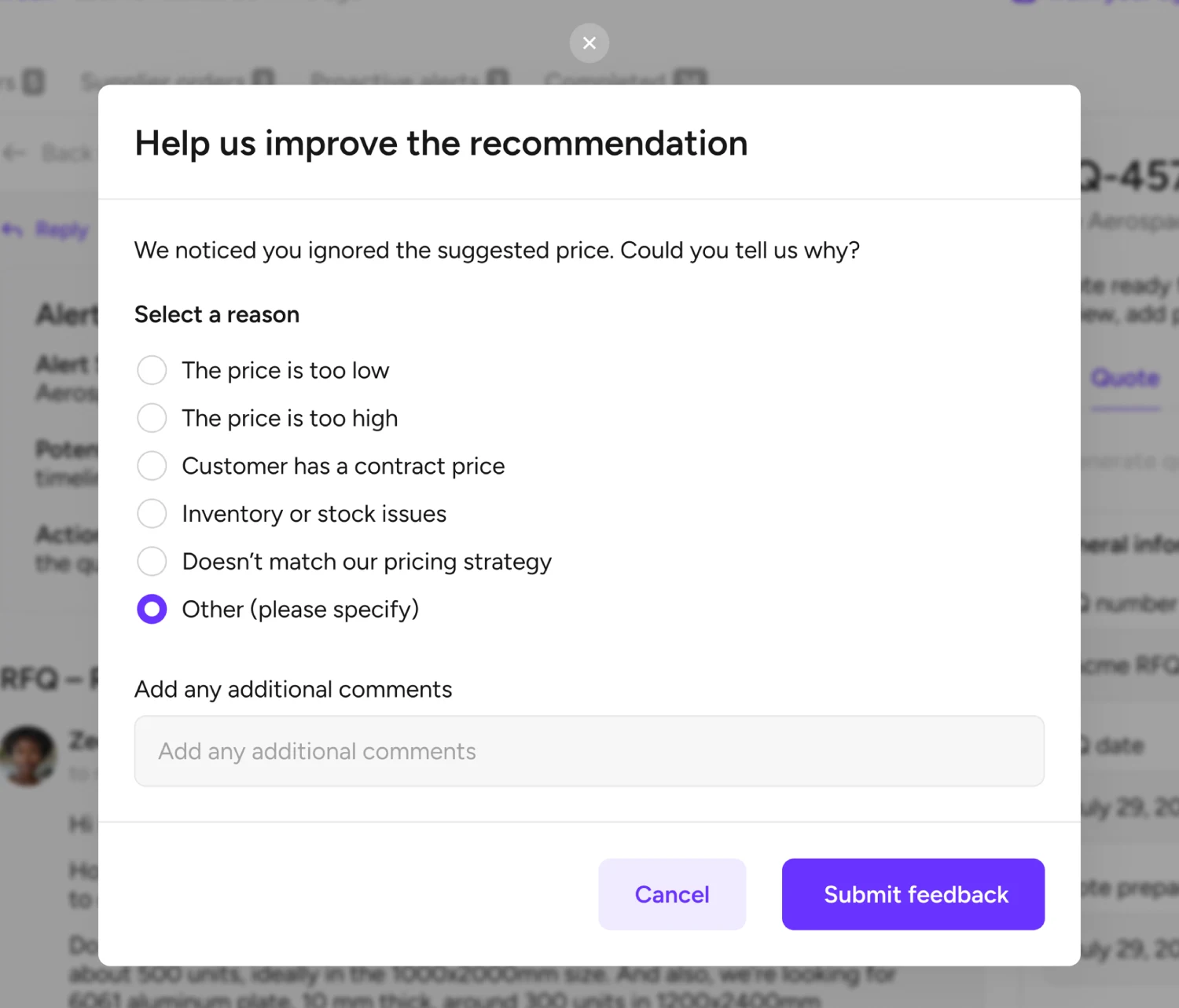

Giving Feedback To Your Agent

You can speak to your agent in natural language to correct or tune recommendations. For example: “For ACME, don’t penalize 90‑day inactivity—procurement cycles are longer,” or “Weight shortage signals more heavily for aerospace‑critical SKUs.” The agent captures this as feedback, updates its feature weighting within your policy guardrails, and applies it next time in similar contexts.

You can also adjust line prices with a short rationale; those signals help the model learn your playbook over time.

A 60‑Second Pass Through the Workflow

The Meta-Benefit

The meta‑benefit is consistency at scale: new reps price like your best reps, and leadership finally sees the drivers behind outcomes across regions and teams.

Pricing is a reflection of how well your commercial systems recognize the moment you’re in. When the RFQ is saved and the quote appears—with context assembled, price recommended, and the email ready to send—you’ve turned a fragile, human‑dependent process into a repeatable advantage. That is the difference between hoping to win and being systematically prepared to win.

Related articles

Introducing AI Agents For Procurement – What They Are & Why They Matter

Procurement leaders today need more than just efficient workflows—they need insights that drive smart decision-making. For decision makers...

Cleaning and Consolidating Parts Data Across ERPs with AI Agents

Many large enterprises, especially in aerospace and manufacturing, operate with multiple ERP...

Why Aerospace Domain Knowledge is Critical for AI Transformation

AI is everywhere, but not all AI is created equal. Generic or “horizontal” AI vendors promise...